What We Offer

The tools to support your life and finances — with clarity and context

At ALLETS Network, we offer practical and strategic support for women facing personal and professional changes — such as career shifts, relocation, divorce or motherhood.

Through community-based programmes, mentoring, and collaborations with organisations, we help you make confident financial decisions that reflect your values, goals and current reality.

Whether you're looking for direction, structure or a more intentional way to manage your finances — this is your space.

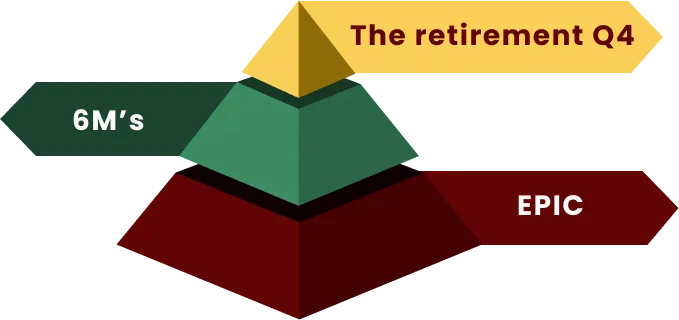

Group Programmes

Our group sessions are designed for women going through transitions — be it in their careers, personal lives, or both.

Each programme includes:

1. Live guidance

2.Personal reflection tools

3. Strategic planning frameworks

4. Mentoring to anchor real change

By the end of the programme, you’ll gain a clearer understanding of your financial identity and money story — along with a plan of action that reflects your needs and values. We also offer tools to help you stay on track and accountable over time.

We cover topics such as:

-

Lifestyle and financial choices around pensions (values-based and practical)

-

Income structure, earning clarity, and money flow

-

Identity shifts (e.g. relocation, motherhood, separation)

-

Energy awareness and sustainable money habits

-

Your money story and financial identity

Pre-Session Intake

📝 Every programme or collaboration begins with a short intake to establish direction, manage expectations, and ensure the right fit.

Your intake includes:

1. A one-to-one or group session (depending on context)

2. A short pre-questionnaire to align goals and needs

3. Initial clarity on where you are and what support best suits your context

📍 Available in Dutch, English, and Portuguese

This intake step ensures clarity and direction from the start for both individual and group settings. It helps align expectations, focus the content on what matters most, and lay the foundation for lasting change.

Organisation Partnerships

🏢 We collaborate with organisations, municipalities, and support services to deliver community-centred financial planning programmes.

These partnerships help expand access to:

Financial well-being workshops grounded in real-life transitions.

Support for women going through income changes, career shifts, or personal reinvention

Resources that encourage sustainable money habits and future-oriented decisions.

We offer multilingual delivery in Dutch, English, and Portuguese — always rooted in context, dignity, and accessibility.

Not sure what’s right for you?

We know that making changes in your financial and personal life can feel like a lot — especially when you're already dealing with daily responsibilities. That’s why we’re here to help you make focused, conscious decisions that match your current stage and future needs.

Our programmes are available in Dutch, Portuguese, and English. If you're not sure what suits your situation, you're welcome to start with a free clarity call to discuss what would be most helpful for you.